Digital asset manager CoinShares says Ethereum (ETH) rival Solana (SOL) is an institutional favorite as the cryptocurrency market overflows with Bitcoin (BTC) exchange-traded fund (ETF) fervor. .

In its latest report on digital asset fund flows, CoinShares finds that institutional investors have invested more money in Solana than any other digital asset other than BTC over the last week and year.

“Solana recorded additional inflows of $15.5 million last week, bringing year-to-date inflows to $74 million (47% of assets under management). [assets under management]) – making it the most popular altcoin this year so far.”

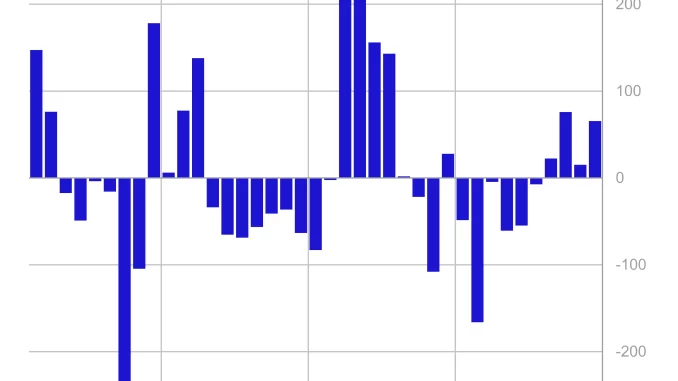

Overall, digital asset markets experienced their fourth consecutive week of institutional inflows. According to CoinShares, part of the momentum may come from growing anticipation of the approval of a spot Bitcoin ETF in the United States.

“Digital asset investment products recorded inflows for the fourth consecutive week for a total of $66 million. Total assets under management have now increased to $33 billion.

While the most recent inflows are likely related to enthusiasm over the launch of a spot bitcoin ETF in the US, they are relatively low compared to the June announcements, suggesting more caution on the part of investors this time”.

Source: CoinShares

Institutional BTC investment products raised over $55 million in inflows last week, while BTC short products raised $1.6 million.

While altcoins Binance Coin (BNB) and Cardano (ADA) enjoyed minor inflows of $0.2 million and $0.1 million respectively, Ethereum (ETH) products bled $7.4 million.

“Continued concerns over Ethereum have led to new outflows of $7.4 million, the only altcoin to record outflows last week.”

Don’t miss a thing – sign up to receive email alerts directly to your inbox

Check price action

Follow us Twitter, Facebook and Telegram

Surf Hodl’s Daily Mix

Check out the latest news headlines

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that your transfers and trading are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is it an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/tykcartoon/Tun_Thanakorn

source: dailyhodl.com